Canadians pinching their pennies to buy a first home are getting a break from the federal government.

April 1 marks the launch of the First Home Savings Account ; a savings vehicle with the combined tax perks of a Registered Retirement Savings Plan and a Tax-Free Savings Account .

After withdrawing money from an FHSA, you must purchase a home by October 1 of the following calendar year or it will be taxed as income. If it is not used for a home purchase by the age of 40, it can be converted to normal RRSP savings.Forty thousand dollars is well above the five per cent minimum down payment required on a house under $500,000, but there are ways to boost it by combining the alphabet soup of government registered accounts available to most Canadians.

Just about any type of investment - stocks, bonds, mutual funds - are permitted in a FHSA but the short-term nature of an FHSA calls for a short-term investment strategy. FHSAs, on the other hand, would likely have a hard deadline to liquidate investments when the opportunity to buy a home arises.

المملكة العربية السعودية أحدث الأخبار, المملكة العربية السعودية عناوين

Similar News:يمكنك أيضًا قراءة قصص إخبارية مشابهة لهذه التي قمنا بجمعها من مصادر إخبارية أخرى.

Increased taxes on wealthy Canadians likely recoverable: Tax expert - BNN BloombergFollowing a proposed move by Canada’s federal government to increase the minimum tax rate on wealthy individuals, one tax expert said the minimum tax is often recoverable.

Increased taxes on wealthy Canadians likely recoverable: Tax expert - BNN BloombergFollowing a proposed move by Canada’s federal government to increase the minimum tax rate on wealthy individuals, one tax expert said the minimum tax is often recoverable.

اقرأ أكثر »

Nearly half of Canadians buying or renewing concerned about mortgage qualification: survey - BNN BloombergCanadians who are renewing their mortgage or buying a home are increasingly concerned about their ability to qualify for the mortgage they need, and are considering alternatives to traditional lenders as a result.

Nearly half of Canadians buying or renewing concerned about mortgage qualification: survey - BNN BloombergCanadians who are renewing their mortgage or buying a home are increasingly concerned about their ability to qualify for the mortgage they need, and are considering alternatives to traditional lenders as a result.

اقرأ أكثر »

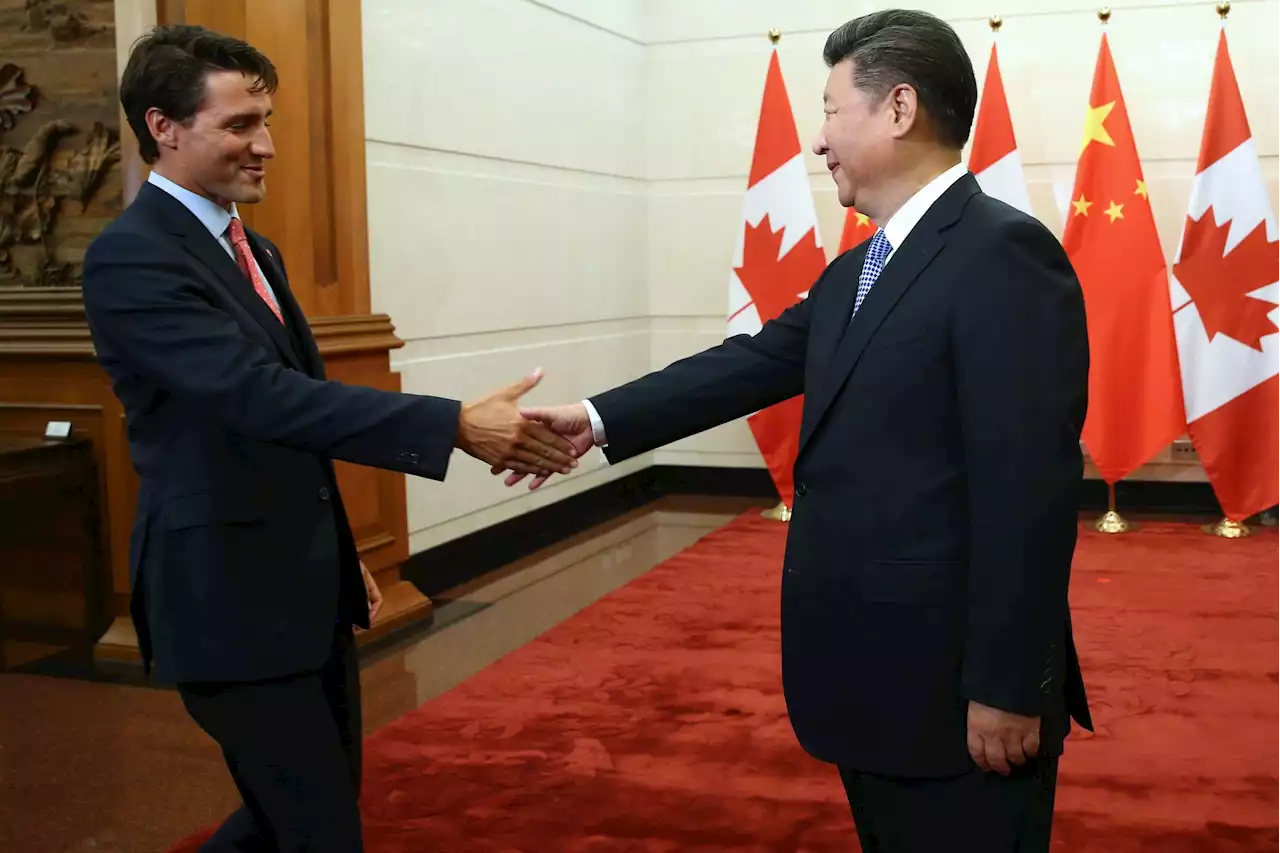

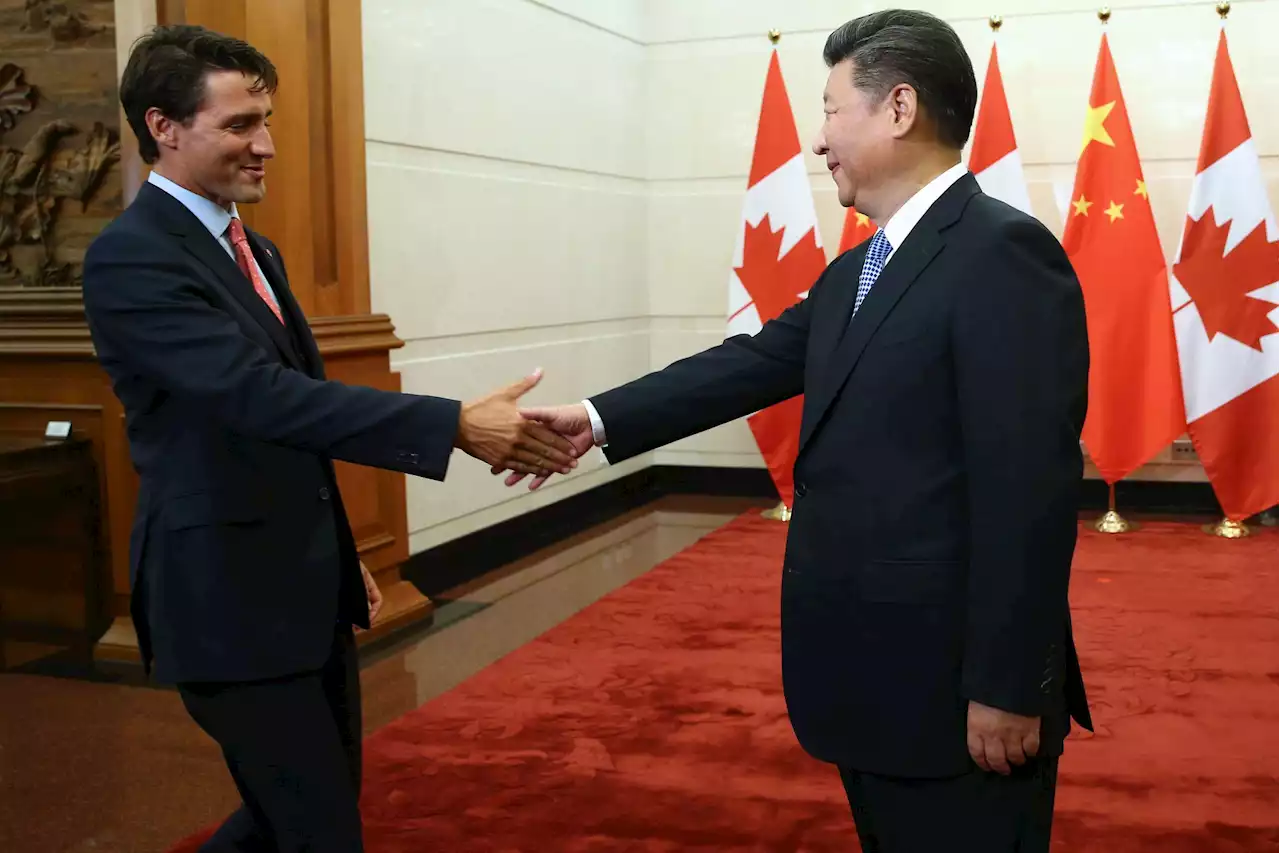

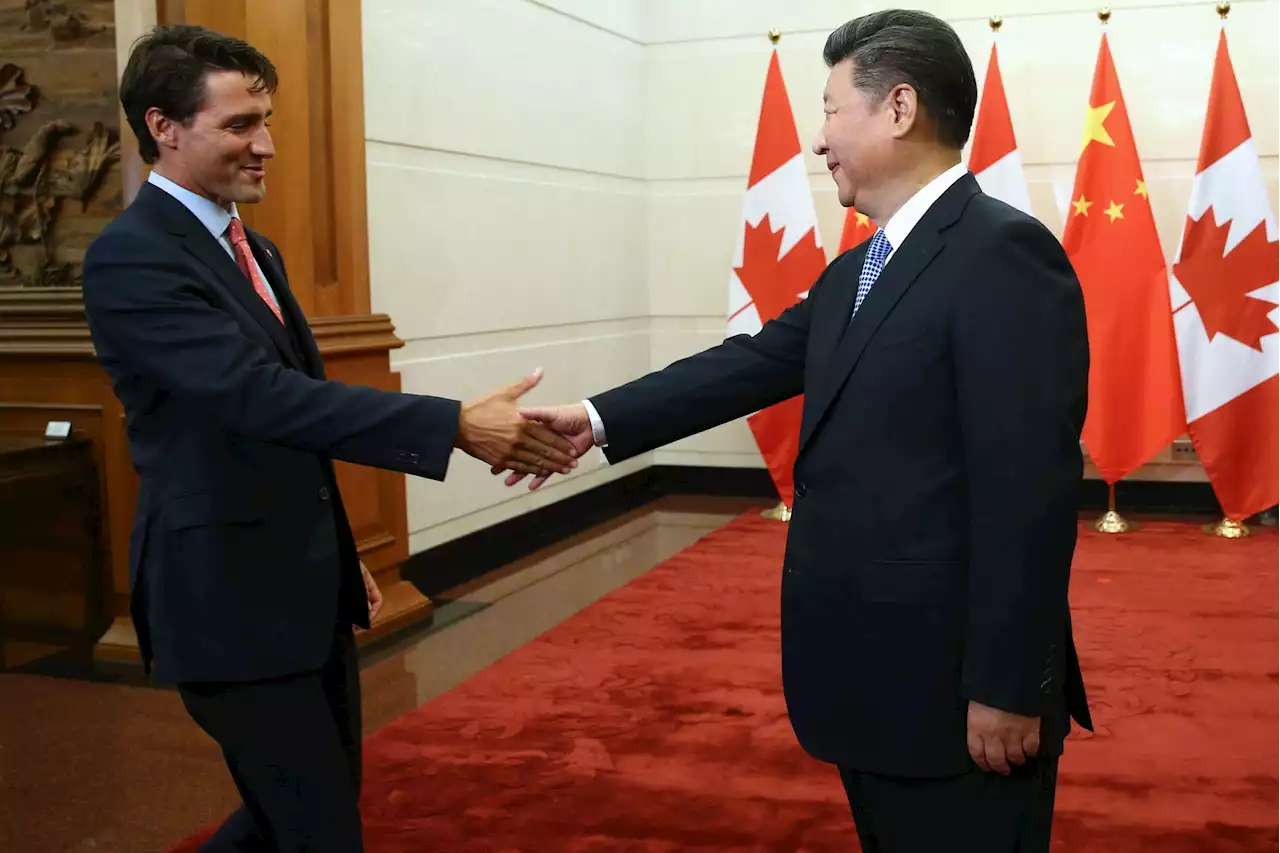

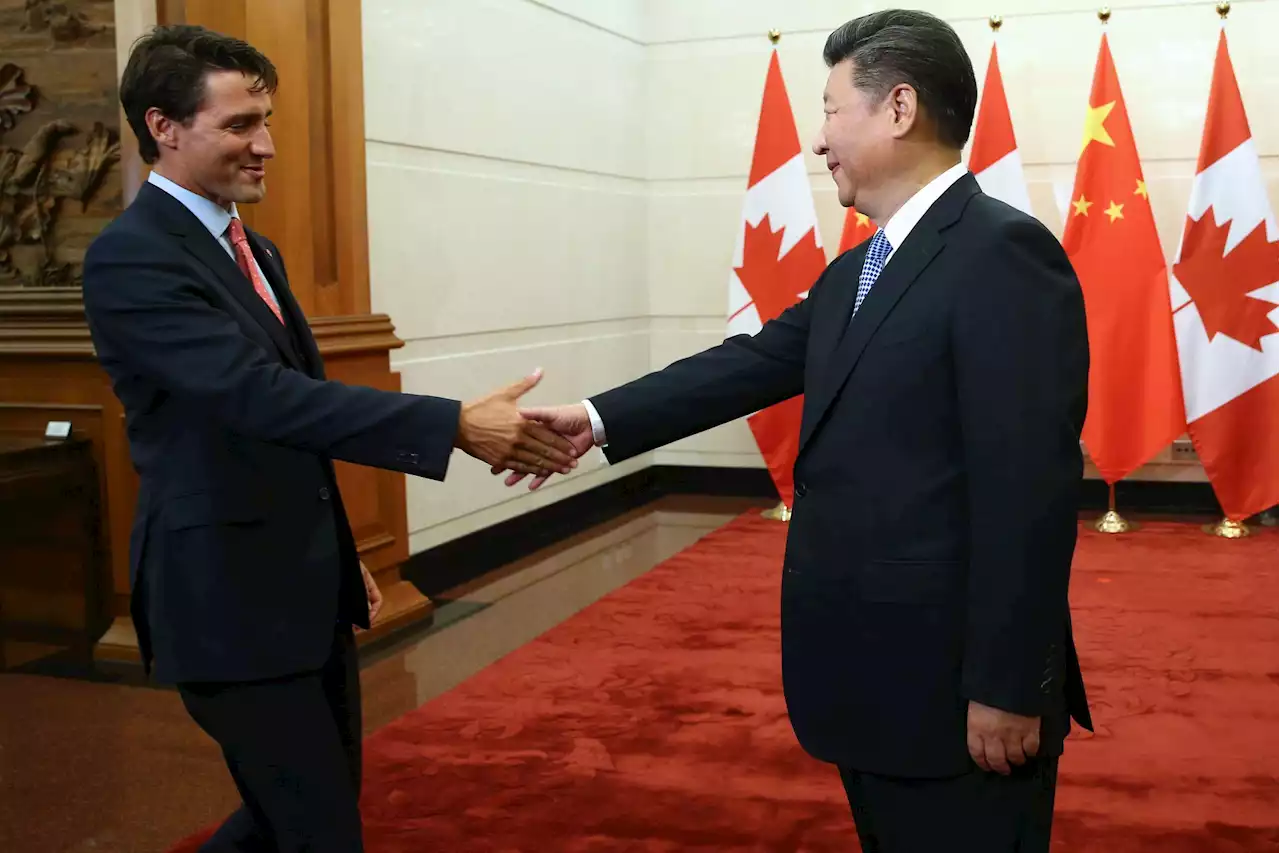

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

اقرأ أكثر »

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

اقرأ أكثر »

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

اقرأ أكثر »

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

A third of Chinese Canadians believe Beijing meddling in elections, pressuring Canadians: pollSix per cent of Chinese Canadians polled even said they had personally been pressured by an apparent Beijing representative

اقرأ أكثر »